Best in Class Instructors

Unlimited Access

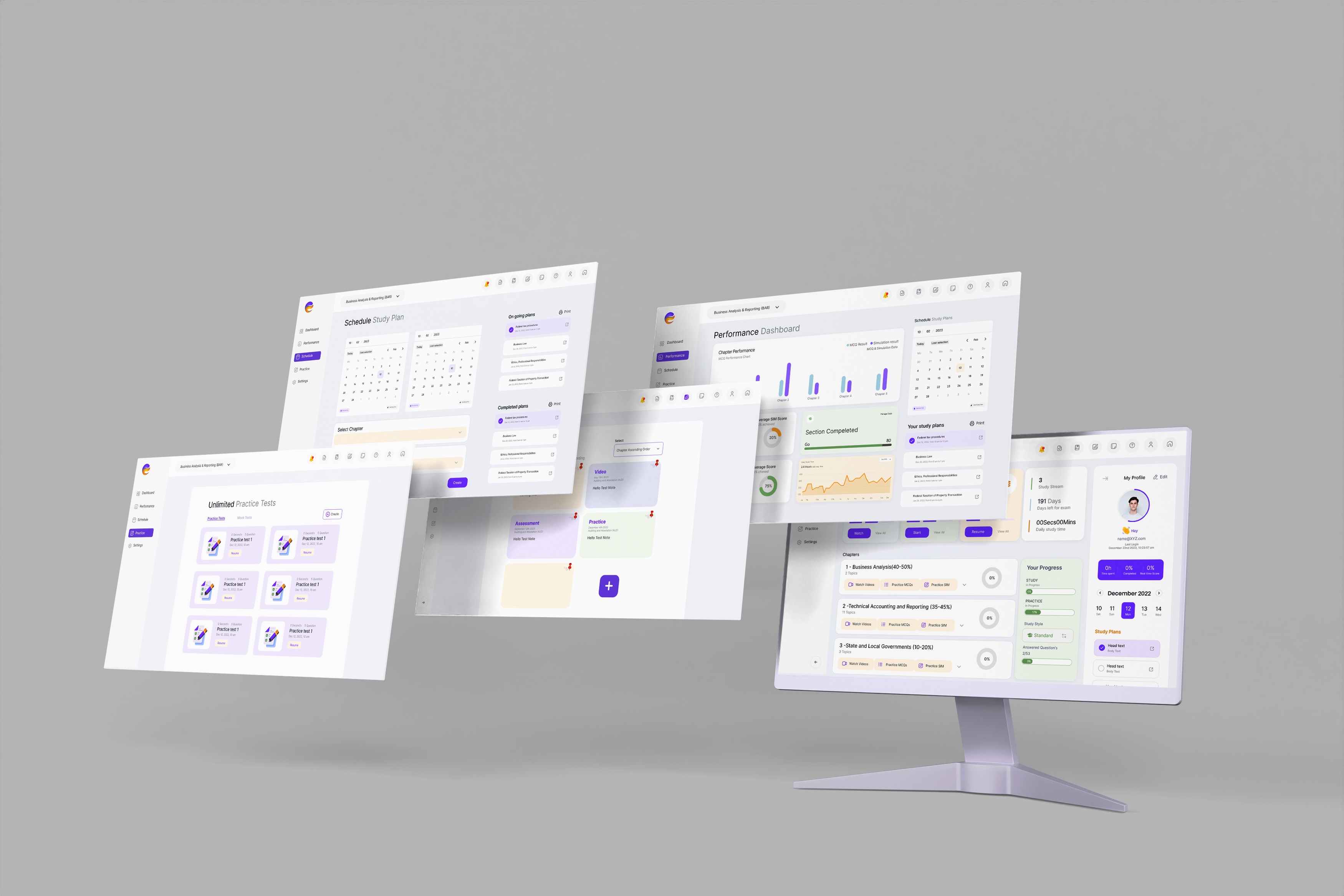

T.E.E.E Technology

High Demand Professional Courses

Guaranteed Success

Placement Support

KC GlobEd's unique and state-of-the-art T.E.E.E technology assesses your strengths and specific areas of need. It formulates a personalized study plan focusing primarily on how to reduce up to 70% of your study time.

Experience education that adapts to your unique needs and pace, ensuring a personalized and effective learning journey.

Stay updated with instant score tracking, providing real-time insights into your performance.

Access a dynamic dashboard that showcases your progress, strengths, and areas for improvement.

Keep tabs on your video learning with insightful reports that track your viewing habits and progress.

Access an extensive library of electronic books to supplement your learning journey.

Hone your skills endlessly with an abundance of practice tests to reinforce your knowledge.

Seamlessly create and manage various course types, from single subjects to comprehensive learning paths, all with ease.

Receive timely and constructive feedback to refine your skills and understanding.

Recognize achievements with customizable badges, promoting a sense of accomplishment among learners.

Because yourFuture Deserves the Best!

All Accessfor Unlimited Growth

ExpertInstructors

High QualityCurated Curriculum

GlobalRecognition

Welcome to a world of tailored learning experiences that go beyond the ordinary.

Unlock dynamic, personalized learning with our AI-powered learning platform.

At KC GlobEd, we're not just an educational institution, we're a thriving community of over 500 finance, audit, tax experts and counting. When you choose us, you don't just get an education, you become part of a dynamic network of professionals who are shaping the future of the industry.