Enrolled Agents (EAs) are federally-authorized tax practitioners empowered by the U.S. Department of the Treasury. They represent taxpayers before the Internal Revenue Service (IRS) and provide tax-related advice, compliance checks, and audits. EAs have broad authority to handle tax issues for individuals, corporations, estates, and more.

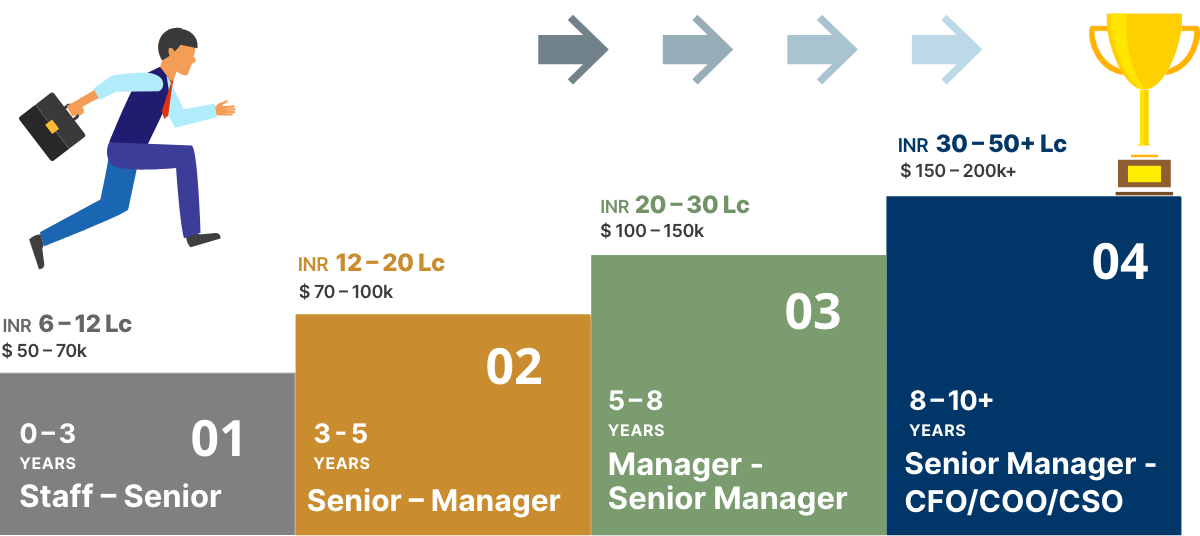

The salary of an Enrolled Agent in India varies significantly based on experience, location, and the hiring organization. Here's a detailed look at the salary ranges:

Entry-Level Salaries

Fresh EAs can expect an average starting salary ranging from INR 6 to 8 lakhs per annum.

Mid-Level Salaries

With 3-5 years of experience, EAs typically earn between INR 12 to 15 lakhs annually.

Senior-Level Salaries

Experienced EAs with over 5 years in the field can earn INR 20 lakhs or more, especially if employed by top firms like the Big 4 (Deloitte, PwC, EY, KPMG).

Salaries in metropolitan areas are generally higher due to the cost of living and demand.

Working with renowned firms often offers higher pay and better career growth opportunities.

EAs with expertise in niche areas like international tax or corporate tax advisory can command higher salaries.

Becoming an EA opens up various high-profile job opportunities in both the private and public sectors:

Provides expert advice on complex tax matters, international tax planning, mergers, and acquisitions.

Manages tax return preparations for individuals and businesses, ensuring compliance with tax laws.

Acts as a liaison between taxpayers and the IRS, handling audits, disputes, and negotiations.

Advises corporations on tax strategies to minimize liabilities and enhance tax efficiency.

Manages tax-related issues for trusts and estates, ensuring compliance and efficient asset transition.

Focuses on tax planning and compliance for small businesses, helping them grow while adhering to tax regulations.

Ensures that organizations comply with all tax laws and regulations through regular audits and reviews.

Investigates financial discrepancies and fraud, providing expert testimony in legal proceedings.

As the demand for skilled tax professionals grows, EAs are well-positioned to leverage their expertise for career advancement and financial success. For those looking to pursue this certification, enrolling in comprehensive EA courses can be a significant step towards achieving these career goals.

For more detailed insights and up-to-date information, visit KC GlobEd.